Gunbot Strategy Overview Elliott Waves Oscillator

Gunbot Strategy Overview – Elliott Waves Oscillator

Here it is another futures strategy that will work with your professional gunbot Market_Maker bot, It’s based on Elliot Waves principle, let’s dig into it.

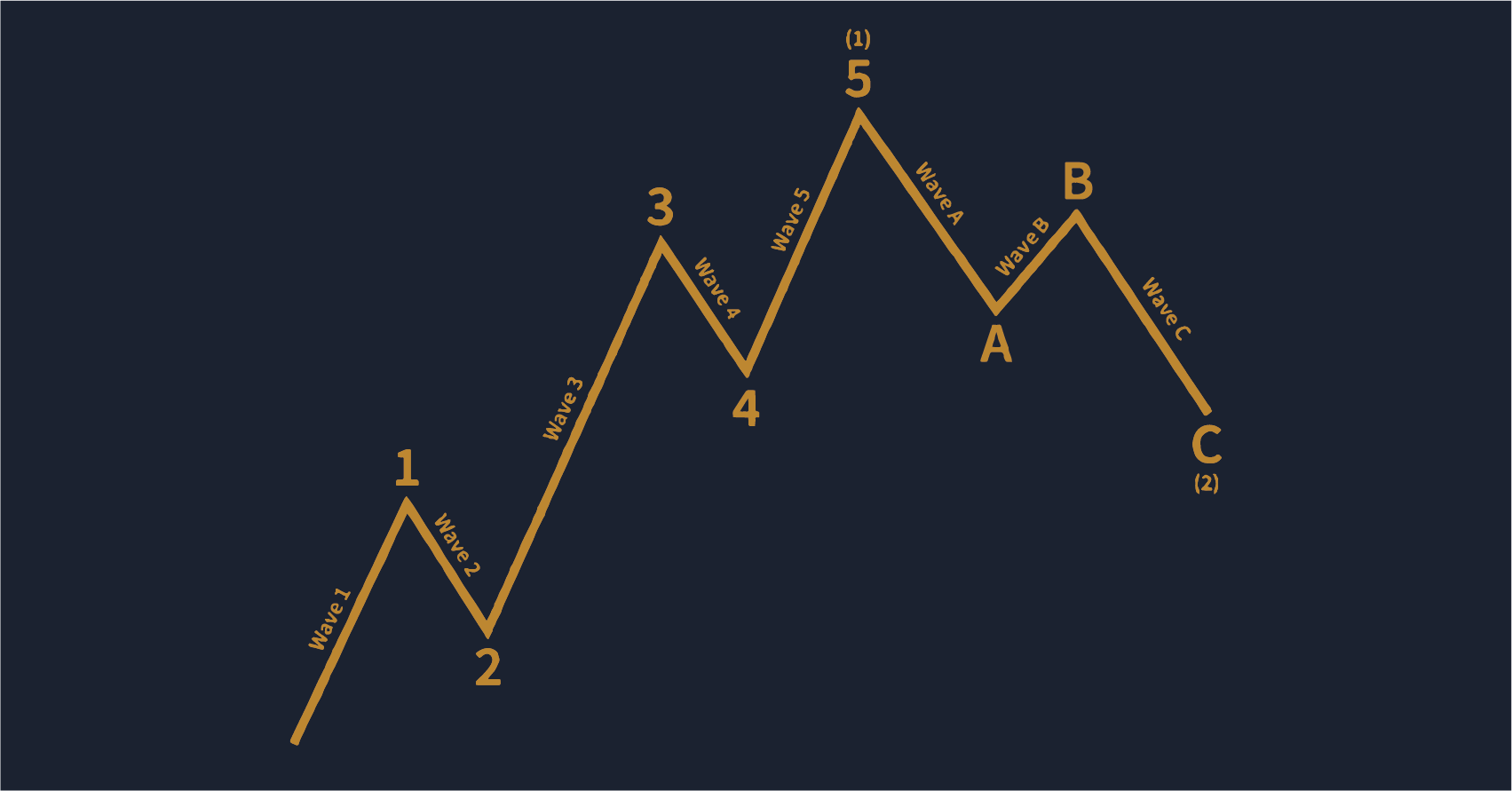

Elliott Wave Theory

Developed by Ralph Nelson Elliott, author of the Elliott Wave Theory, and presented in his book The Wave Principle in 1938. In 1939, it was summarised in a series of articles in the Financial World magazine, the EWO is an indicator used to determine where an Elliott wave ends and another wave begins. It aims to offset one of the Elliott Wave Theories’ main weaknesses – the reliance on accurate wave counting.

The Elliott Oscillator has a robust correlation with Elliott wave patterns and its strongest readings typically show you where the third wave is on the chart. The EWO can be applied to each timeframe and will work equally well if the sample size is large enough.

Elliot Wave Strategy in Gunbot

Elliot Wave indicator has been added to GUI as an indicator you can directly put in your chart and use it manually with the trading terminal as well and here is the important feature is a whole new strategy in Market Maker variants. As a momentum indicator it can be used in sideways and breakouts, so it’s the first time we got a strategy that can signal a breakout, that’s a milestone achieved. Take into consideration that it will use market orders for open and close so set your ROE accordingly.

- – It can open Longs/Shorts on EWO crossing UP /crossing DOWN 0.

- – BreakDown / BreakUp signals.

- – Tenkan-Sen signal close and roe scalper close the position.

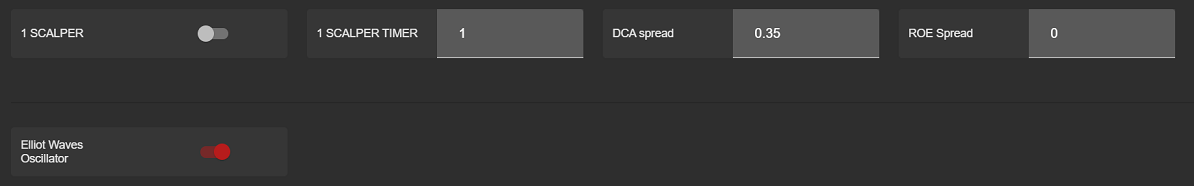

- – DCA is handled by the strategy as well, you can safely set really short DCA_SPREAD (please take always in consideration the volatility of the coin) it will DCA when EWO signals.

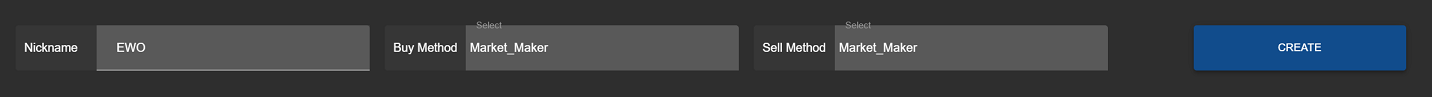

How to configure EWO in your strategy if you have a Market_Maker BOT

- – Open Strategy Editor.

- – Add new Strategy with config below.

- – Configure your ROE without any ROE_TRAILING.

- – Configure your MOC accordingly if you’re trading futures linear contracts or inverse swap contracts.

- – In Variants TAB toggle on EWO and configure DCA spread.

- – Save changes.

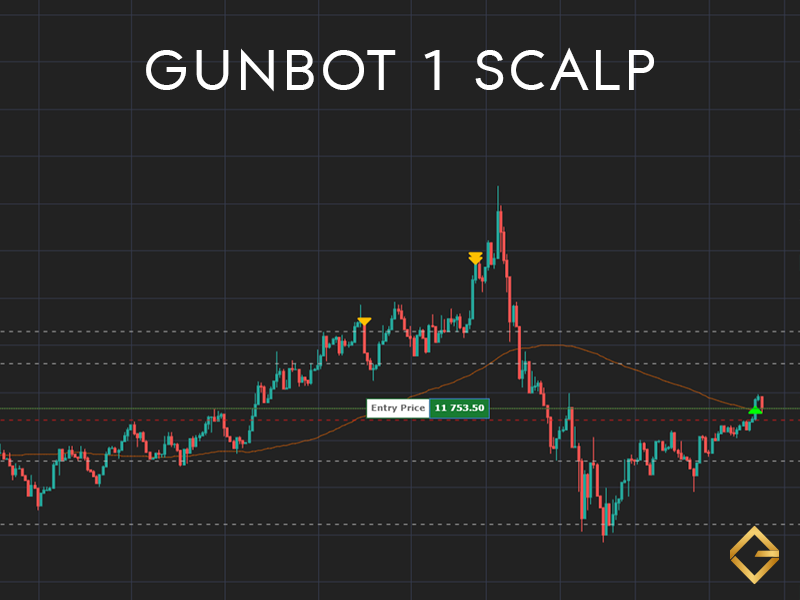

EWO in Effect and how it works.

- – It closed my short here. When Tenkan passes through the body of the candle then ROE Scalper started trailing and closed.

- – It opened another short here when EWO crossed down 0 value.

- – It closed my short when Tenkan-Sen crossed up the candle body then triggered ROE Scalper.

Take into consideration configuring your risk management specially if you’re trading Futures.

Don’t have Gunbot yet to try our new Market Maker strategy variant.

hurry up & grab your license from one of our Official Resellers and top-up your Gunthy Wallet up to 24000 Gunthies.

That’s all folks and happy gunbottin