Gunbot Strategy Overview Motion of the Ocean (New options Added)

“We sell your hopes, we buy back your desperation”.

That’s the main definition of this strategy, it’s an accumulation and distribution strategy, which means we get some bags that after a while we will release when whales decide that it’s over and the market trend changed.

Mainly is enforcing really aggressive DCA mode to keep your price near AEP as possible, giving you always the opportunity in a giving spike the ability to close your position, combined with the PND feature is a real killer. On the other side you need to assert your risk as MOTO will devour your wallet.

Before we dive deeply into the strategy itself we must get a proper risk calculation based on our wallet and leverage. So play accordingly to your wallet size and leverage, more leverage means exchange will borrow you less total money to put into a contract but each entry in the market will cost less initial margin so there’s a balance between your wallet size and effective leverage in your position in a CROSS margin configuration (default margin in BinanceFutures).

Calculating your risk-based in your wallet in BinanceFutures exchange

The rule of thumb you need to follow is that your maximum position vs your wallet is never near liquidation in Gunbot you can configure that in the MAX OPEN CONTRACTS parameter.

In cross leverage you have a bigger cushion between your entry price and the liquidation but still the reality is that liquidation always exists, at least you should have a 60% threshold from your AEP to Liquidation price, so when that number of contracts is reached STOP adding more contracts to your position or triggering HR to reduce your position.

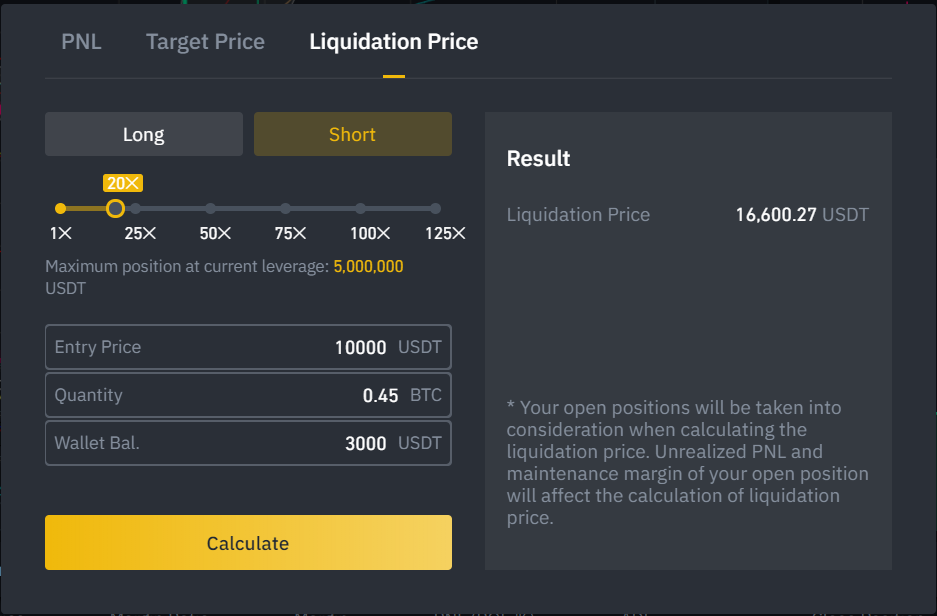

To calculatethe max number of contracts you can achieve without fear of liquidation properly go to binance web app -> Select the pair you want to TRADE (ex. USDT-BTC) -> Click in icon Calculator – click in tab Liquidation Price.

Take into consideration this in Binance Futures there’s no inverse swap contract, which means that you back your contracts with USDT coin that more or less is 1:1 related to US Dollar. So according to this as the price of bitcoin goes UP your TOTAL value in bitcoin goes down, that’s especially important if you trade BITCOIN as you need more USDT to buy the same contract or maintain your position without risk of liquidation if the price is against your position in a short or long. So the calculation is always better to be made with a SHORT contract (Bitmex you’ll use a LONG contract).

So at 20x leverage, if the price of Bitcoin reaches 16,600.27 USDT (without taking into consideration funding as Liquidation price can be reduced over time due to funding) Binance will put my whole contract at market price and get all money from my wallet. And you’ll face the meme image below…

Please in order to avoid this terrifying situation, calculate your leverage accordingly to your wallet and liquidation threshold, and of course we got the right tools to avoid this situation in our lovely market maker so you’re not alone in front of the devil when the market goes against your position.

Controlling your emotions

Especially in margin emotions plays a major role as you can see the fluctuations of negative ROE and positive in real-time if you’re glued to the screen watching the charts. Avoid tampering with the bot doing manual operations unless you perfectly know what you’re doing, as an example is really risky if you’re 400% negative roe and you execute a 1:1 DCA of your contracts, you can perfectly rekt your account.

Gunbot is smart and doesn’t have emotions and knows what to do based on market conditions and risk configuration so just let Gunbot do his job. I’ve seen many times in our market people panicked and closed their positions manually when just waiting for several hours/day(s) they should have closed that position at profit. So keep calm and Gunbot.

Gunbot Strategy configuration for Motion of the Ocean:

First of all, open your GUI and create a new strategy under Buy Method and Sell Method “Market_Maker” and click create as you can see in the image below.

You can configure the Motion of the Ocean Strategy directly from GUI. (New Features Added)

Below you can see a table with the key parameters used in Motion of the Ocean Gunbot Strategy.

[wptb id="1795" not found ]

Warning: apart from those specific parameters mentioned above, you need full access to our Market Maker to have access to all settings available.

Here you can see some charts of several PAIRS of this Awesome Gunbot strategy in action:

Below you can see a chart using MOTION_OF_THE_OCEAN GUNBOT STRATEGY in combination with PULLBACK, it means if MOTO fails the entry then if there’s any “pullback” gunbot will open an entry to ride the PUMP.

That’s all folks, enjoy MOTO Gunbot Strategy

To review our full range of Crypto Trading Bots, go to www.gunthy.org