Gunbot V23 Released New StepGrid Strategy

The Latest Gunbot V23 is Ready for You to Download

Brand New StepGrid Strategy. Want to Know the Way I Run it?

Discover How to Profit with the Gunbot Stable Release and the StepGrid Strategy by Taking Advantage of Gunthar’s article below…

This post was originally released first on the Gunbot Forum

Another stable release is out at GitHub: Gunbot V23.

Download Gunbot Latest Stable Release

A lot of things happened during over 5 years of Gunbot development and over time I like to share with you how I personally use Gunbot for my own entertainment because when other developers and I code Gunbot we have one single target in our minds: make it profitable for our own trading!!!

This is getting better as much as we proceed with daily development, thanks to the continuous feedback we receive from you and thanks also to a big man that decided to stand on my side for some years and is actively contributing with Gunbot core development: @boekenbox better known as Pim.

Together we tuned a special strategy we would like you to try with Gunbot v23: stepGrid

The initial idea came to my mind when I observed Pim’s spotGrid family. Somehow I noticed markets are predictable enough within some range in price without any other indicator. Pure price action but with a reproducible logic: buy whenever the price goes down by “x” value (expressed in price units, for example, 500 dollars) and sell whenever the price goes up by the same “x” value.

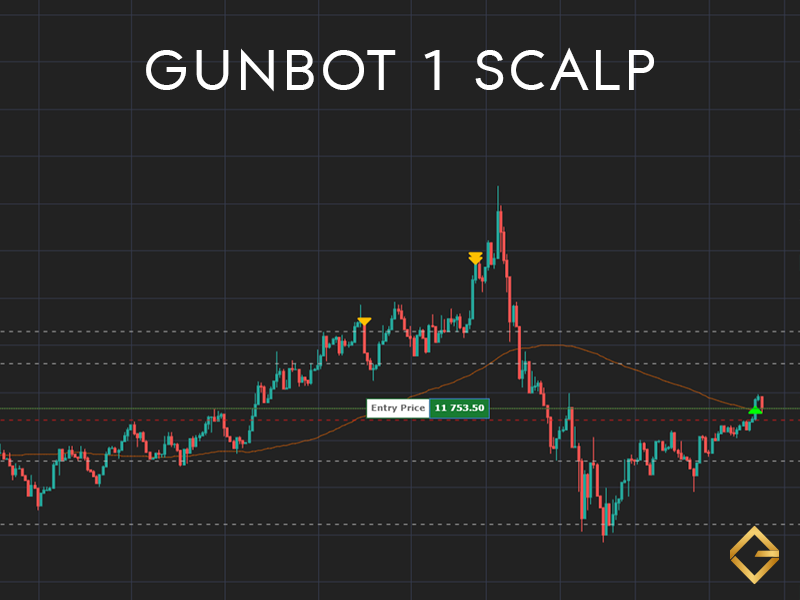

The result of the initial tests was impressive, here is an example of a stepGrid action with the “STEP” (the x value expressed in dollars) set to 500:

Basically, the bot was buying 250 dollars worth of bitcoin every time the price dropped by 500 dollars and selling 250 dollars worth of bitcoin every time the price raised by 500 dollars.

Some basic maths:

- 250 dollars worth of bitcoin at a price of 34k is equal to 0.00735394BTC

- 0.00735394BTC sold at 34.5k is equal to 253.67 dollars

- Net profit 1.46%

This for each trade you see in the above chart ;D

We got excited and started to do some basic tuning: we didn’t want to run out of money so we had to calculate our TRADING_LIMIT based on our wallet balance and taking into consideration the case bitcoin price would have dumped a lot.

Easy peasy, calculate your TRADING_LIMIT based on this formula: walletBalance/(price/step)

For example: with a wallet balance of 10k USD and a bitcoin price at 35k, a “STEP” of 500 dollars would give you 142 dollars max of TRADING_LIMIT

It means doesn’t matter how much the bitcoin price will go down, it could go even to zero, you will keep running your bot without running out of money ever: it means continuous trading taking advantage of perpetual swinging of USDT/BTC pair.

My suggestions:

- Never run out of money or you go back to old times where your bot is stuck and you got useless bags

- Run this strategy only on coins you consider spendable “money” (for example you can fill up your Binance card with a lot of cryptocurrencies, for sure not with DOGE….)

- If you run out of money because you didn’t calculate your TRADING_LIMIT with the above formula, do not fill up your bot while you are in a position: it will start selling at a loss because this strategy doesn’t take into consideration BREAK EVEN unless the price is above your BREAK EVEN

Keep reading this post, there are more exciting things coming…

I mentioned Big Pim early, well let’s celebrate his contribution to Gunbot with some more “facts”:

- He is the one that writes our wiki

- He is the one that coded AutoConfig for u

- He is the one that helped me coding the actual GUI and is actually refactoring/fine-tuning it completely based on your feedbacks

- He is the one that coded customStrategy for us

- He is the one that coded spotGrid and futuresGrid strategies families

Do you think he did stay calm and quiet when we started to code this stepGrid thing? ;D

Wrong assumption: he ported to stepGrid the automatic trailing from SG family on both buy and sell orders and also he developed a system that would adjust your STEP automatically as the pair swinging range would tight or wide ;D ;D ;D ;D

YES! The STEP value is calculated automatically, no need for any special settings. It watches continuously that specific pair volatility and adjusts the STEP internally to always stay glued to the price action and trade!!!!

In case you want to run manual steps, set AUTO_STEP_SIZE: false and enter a STEP_SIZE that represents a price. With ENFORCE_STEP, instead, you can make it respect steps when trailing (personally Pim prefers not to). It also supports Keep_Quote.

The complete wiki for this strategy is available at the Gunbot Wiki

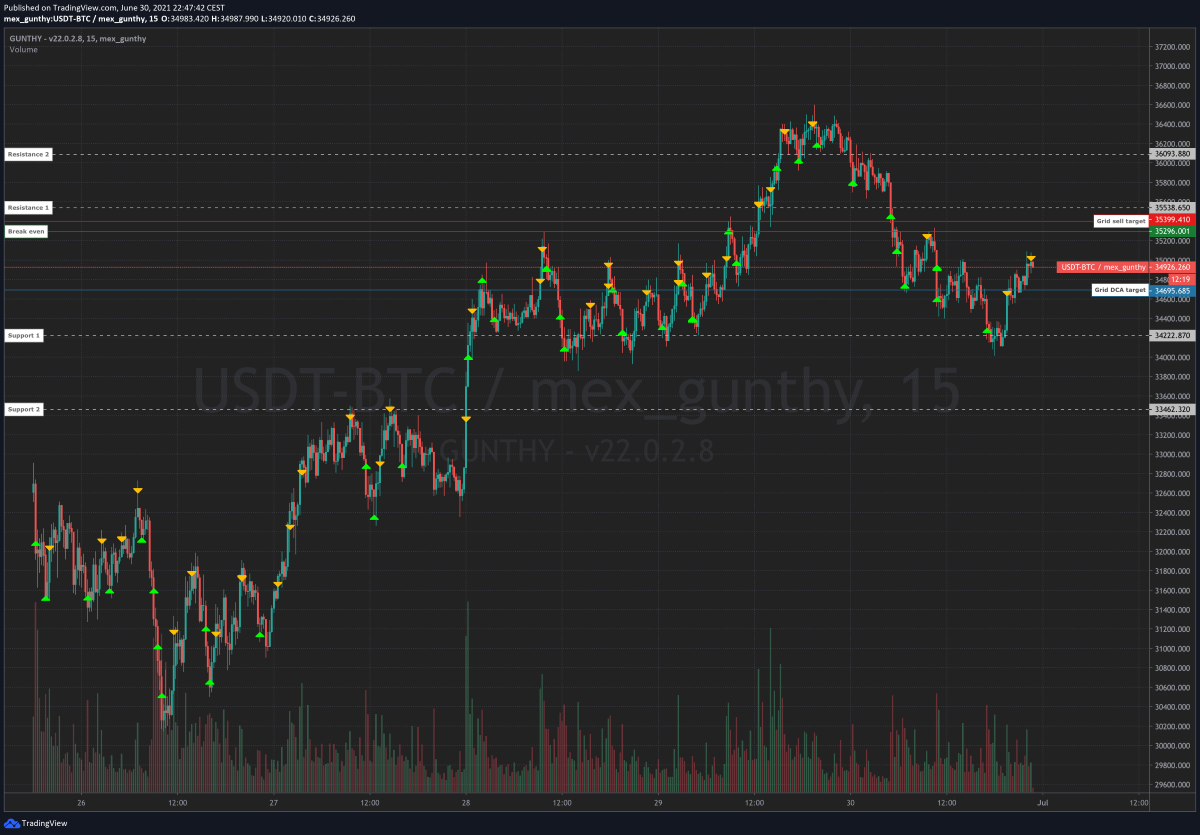

Results are amazing and Pim tested it on a bunch of shitcoins as well, here are some of his impressive charts:

Alright, time to go back to coding: I want to dedicate this summer to complete and release bitRage but, given the excellent results Gunbot achieves, I’ve decided to start to make my life dream come true. I’ve started a bunch of Gunbot in a bunch of exchanges and I’ve bought a little fish boat, someone already calling it Gunboat ;D

I want to code listening to seagulls and sea waves…

Happy Summer 2021!

~Gun