Leveraging Gunbot for the 2024 Bitcoin Halving

Leveraging Gunbot for the 2024 Bitcoin Halving

As the 2024 Bitcoin halving event draws near, the role of automated trading solutions like Gunbot becomes increasingly crucial. The Bitcoin halving, a scheduled reduction in the reward for mining new blocks, significantly impacts the Bitcoin supply, often leading to increased market volatility. With the recent approval of Bitcoin ETFs in January 2024, the trading landscape is poised for substantial shifts. Gunbot, known for its robust strategies and customization options, offers traders an edge in adapting to these changes, maximizing opportunities presented by the halving event.

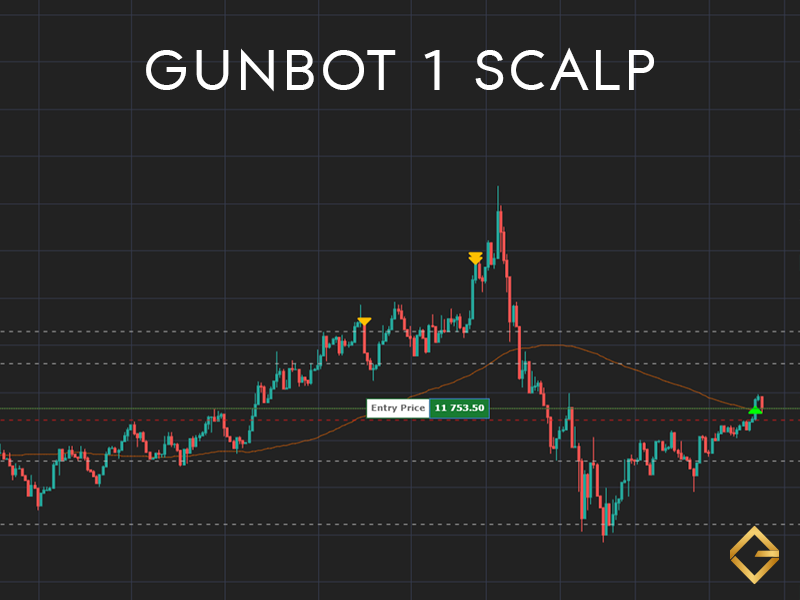

In the image above you can see a chart of USDT-ETH accumulating Ethereum before the Bitcoin Halving event using our incredible quanta_g_type strategy.

Optimizing Strategies for Halving Dynamics

The halving event typically ushers in periods of significant price volatility and market speculation. Gunbot users can leverage this environment by deploying strategies that thrive in volatile markets. For instance, using Gunbot’s “stepgrid Scalp” or “TSSL” (Trailing Stop / Stop Limit) strategies, traders can set adaptive parameters that automatically adjust buy and sell orders based on real-time market movements, capturing profits from sudden price swings.

Enhancing Portfolio Diversification

The introduction of Bitcoin ETFs brings a fresh influx of institutional and retail investors into the market, potentially increasing the liquidity and price stability of Bitcoin and other cryptocurrencies. Gunbot users can diversify their trading strategies across multiple assets, including those likely to be impacted by the ETFs, to spread risk and increase potential returns. The bot’s ability to manage multiple currency pairs simultaneously allows for a broad market presence, ensuring traders are well-positioned to take advantage of diverse market movements.

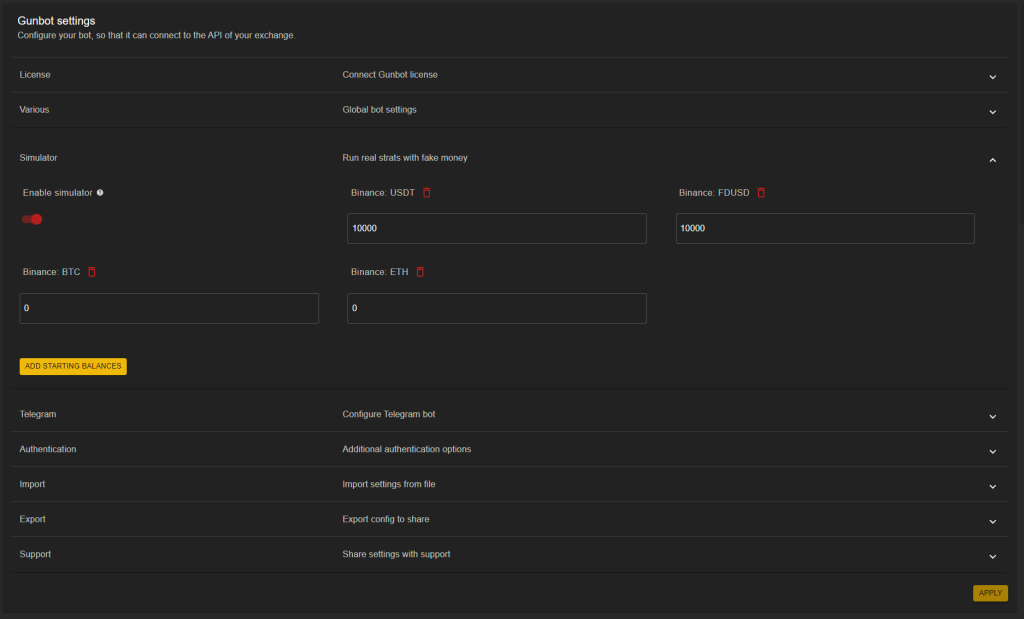

Maximizing Halving Opportunities with Gunbot’s Simulator

Gunbot Ultimate includes a simulator feature that allows for completely simulated trading to forward test real strategies with fake balances. This can be particularly useful for our community to prepare and take advantage of market conditions leading up to and following the Bitcoin halving. By simulating strategies with real market data, users can refine their approach without financial risk, optimizing their trading setups to capitalize on potential market shifts induced by the halving and the introduction of Bitcoin ETFs.

- With just a few clicks, you can seamlessly transform Gunbot into a comprehensive simulator, enabling you to test strategies in a risk-free environment.

Community Support and Shared Knowledge

The Gunbot community, a vibrant group of traders and enthusiasts, is a treasure trove of knowledge, strategies, and tips. Engaging with the community through forums, Telegram groups, or other social platforms can offer additional perspectives and strategies tailored to the halving event. Collective wisdom and shared experiences can be invaluable, especially when navigating the uncharted waters of a Bitcoin halving and the nascent territory of Bitcoin ETFs.

Preparing for Post-Halving Market Conditions

Post-halving, the market may enter a phase of revaluation as it adjusts to the new supply dynamics. Gunbot traders can stay ahead by employing strategies that are flexible and can be quickly adapted to changing market sentiments. The bot’s ability to automate and execute strategies 24/7 ensures that traders won’t miss out on sudden market movements, even in the most unpredictable phases.

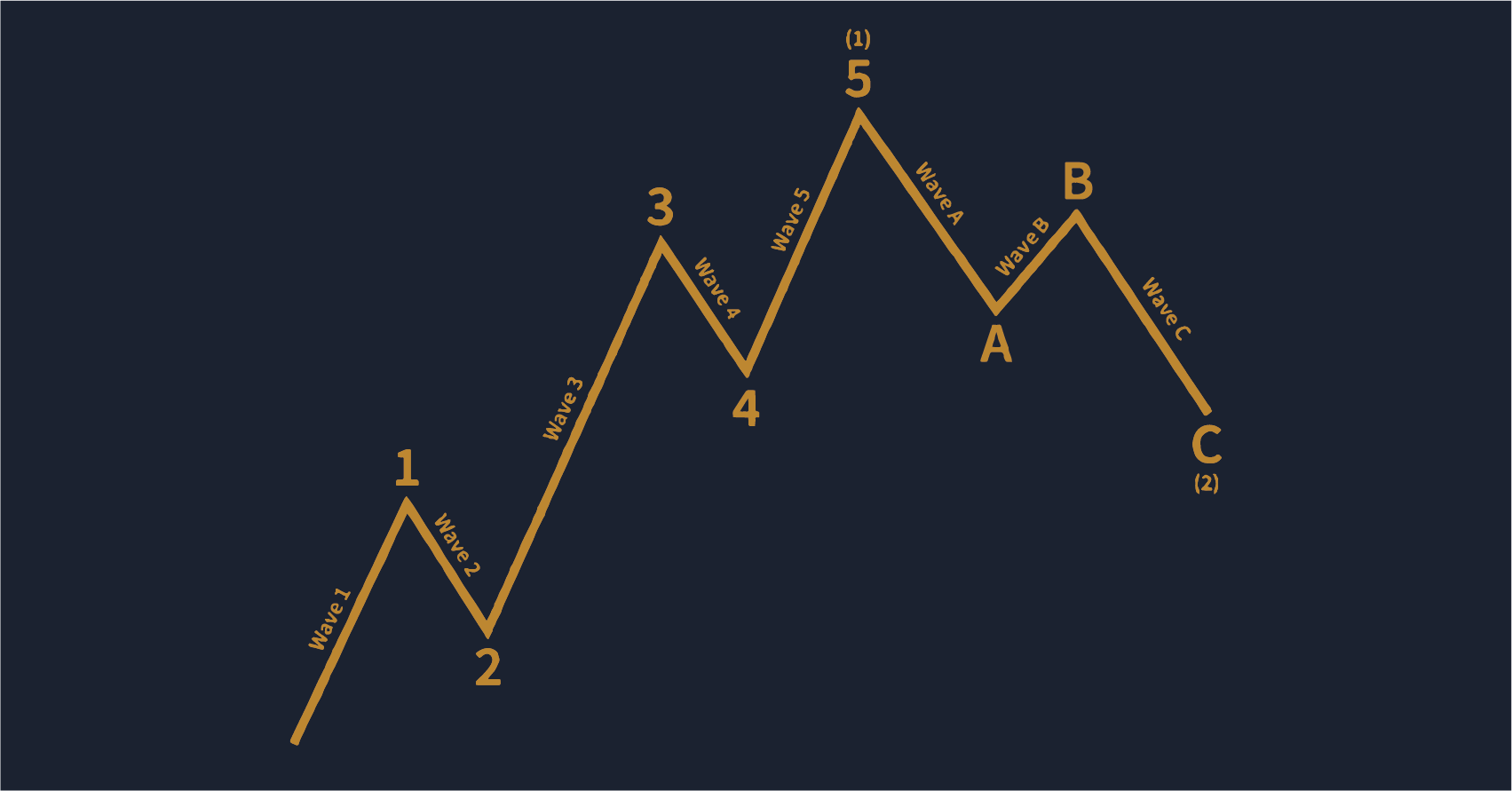

In the image below, you can observe the market correction that followed after Bitcoin reached its all-time high (ATH) on the last Bitcoin Halving.

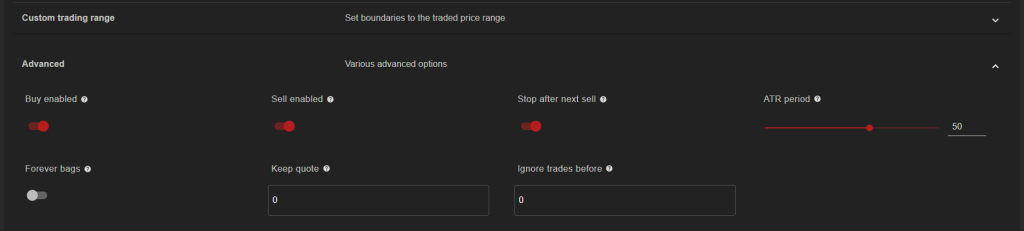

- You can adjust your Gunbot’s grid strategies to stop trading after selling and buying when Bitcoin reaches a new all-time high (ATH). This pause allows you to review the charts and decide whether to continue trading or enjoy your profits. Typically, a market correction follows a new ATH, so it’s crucial to do your own research (DYOR) and consider taking profits, as securing gains can prevent potential losses.

- See above an example of Stop after sell in stepgrid Scalp strategy.

Conclusion: Embracing Automation for Halving Opportunities

The 2024 Bitcoin halving and the advent of Bitcoin ETFs present a unique set of opportunities and challenges for cryptocurrency traders. By leveraging Gunbot, with its advanced trading strategies, backtesting capabilities, and the supportive community, traders in our community can position themselves to take full advantage of the potential market shifts these events may bring. As always, while automation and community insights can provide significant advantages, traders should also remain vigilant, conducting their due diligence and staying informed about the latest market developments.

In this dynamic period, Gunbot stands as a powerful tool and ally for traders aiming to maximize their halving gains, offering a blend of automation, flexibility, and community-backed intelligence to navigate the evolving crypto landscape.

Whether you’re new to Gunbot or a seasoned lifetime customer, the Bitcoin Halving promotion is the perfect time to enhance your trading strategy. With every license purchase or upgrade during this period, you’ll receive an additional slot, allowing for more trading flexibility on your preferred exchange or the opportunity to introduce Gunbot to a friend.

Don’t miss out on the chance to utilize one of the most advanced crypto trading bot in the market, known for its exceptional GUI and UX. Elevate your trading experience now. For more details visit the official Gunbot website or, if you speak Spanish, purchase from our official Spanish site.

That’s all, folks, happy bot trading ATH!