Risk Management in Crypto Trading

Risk management in crypto trading, what is it, and why is it important?

Take advantage of proper risk management in crypto trading so you can reap the rewards of your cryptocurrency trades.

Undoubtedly, roughly 80-95% of new traders have encountered crypto trading accounts with zero balance and shattered dreams this year. Of course, many mistakes were made, but none would have resulted in zero balance if they had included a proper risk management plan in the project.

Crypto trading should be a straightforward path to financial elevation, but many traders see it as a way to “get rich quick.” No, it’s not! How do you deal with this? Let’s see. Here’s the article I promised you last week.

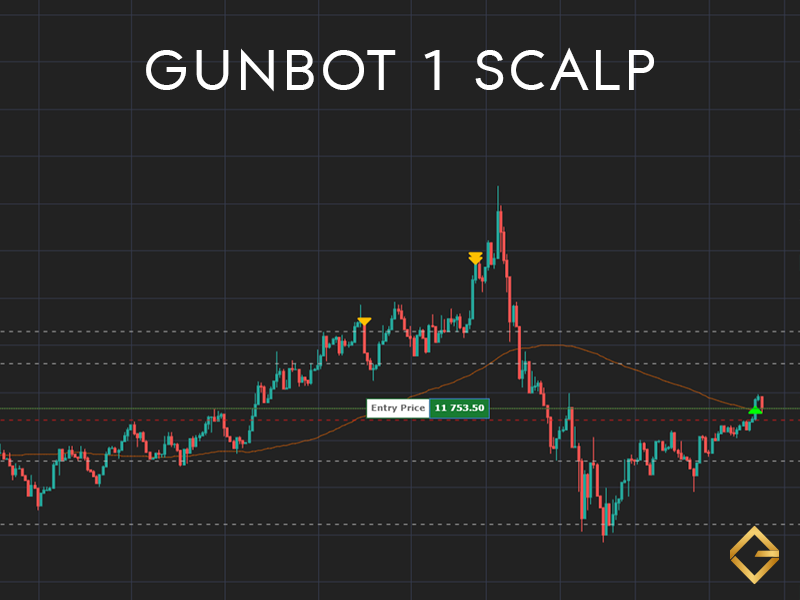

Gunbot, the ultimate crypto trading bot, offers many choices so you can fine-tune your strategy and protect your assets. You can add features like Stop Limit, DCA, or RT to any trading methods.

So, read on! Even if you don’t have Gunbot yet, this article will give you an overview of how to manage your crypto trading risk.

Risk Management in Crypto Trading.

Cryptocurrency has grown over the years, as its market cap experienced a meteoric rise from $336 billion in 2017 to more than $1 trillion in mid-2021.

Have you been listening to any conversations lately? It’s all about Bitcoin. All discussions in workplaces are also about bullish coins. The buzzword in online chat rooms is about cryptocurrencies these days—thanks to the growing popularity of these crypto assets.

So, it goes without saying that if you want to be successful in the crypto world, you need to have your nose for the news and do your homework.

Narrow your coin list down to a few cryptocurrencies. Analyze and decide which ones have the potential to trade higher and the ones to include in your portfolio.

You will research information on blockchain trends from a variety of sources. Today, several commercial channels devote exclusive time to these trends.

Yet, after all these, you’ll buy and still find yourself at a massive loss. Why? What’s wrong? Here is where risk management comes into place!

Risk management in crypto trading is like a firewall to your assets.

Why is it so important? Risk management is essential to any crypto trading plan because it helps you prioritize and organize your portfolio, thus reducing the chances of a potential wipe-out.

Risk management in crypto trading impacts the outcome of a specific trade. For instance, a 20% probability of a $100,000 loss has an expected value of ($20,000) while a 10% probability of a $1,000,000 gain has an expected value of $100,000.

As a trader, you should frequently assess the risk in your account to minimize loss and maximize profits.

A risk management plan helps preserve your capital by providing pre-set and well-calibrated exit points while earning constant profits. It also helps curb your emotions while enforcing self-discipline.

Here are the essential elements of risk management in crypto trading.

How to prevent losses and trade safely?

As you know, there are inherent risks associated with this market, and if you are not careful, you may lose big money and all your investments within a few trades.

Irrespective of whether you are a beginner or an experienced trader, you need to have a proper risk management plan for every trade.

Evaluating trade risk is always an essential part of your crypto trading business. Before you enter a trade, it is wise to determine if the risk you’re taking is in the right proportion with your account size and the potential profit.

There are many ways to have an effective risk management policy. Below are a few.

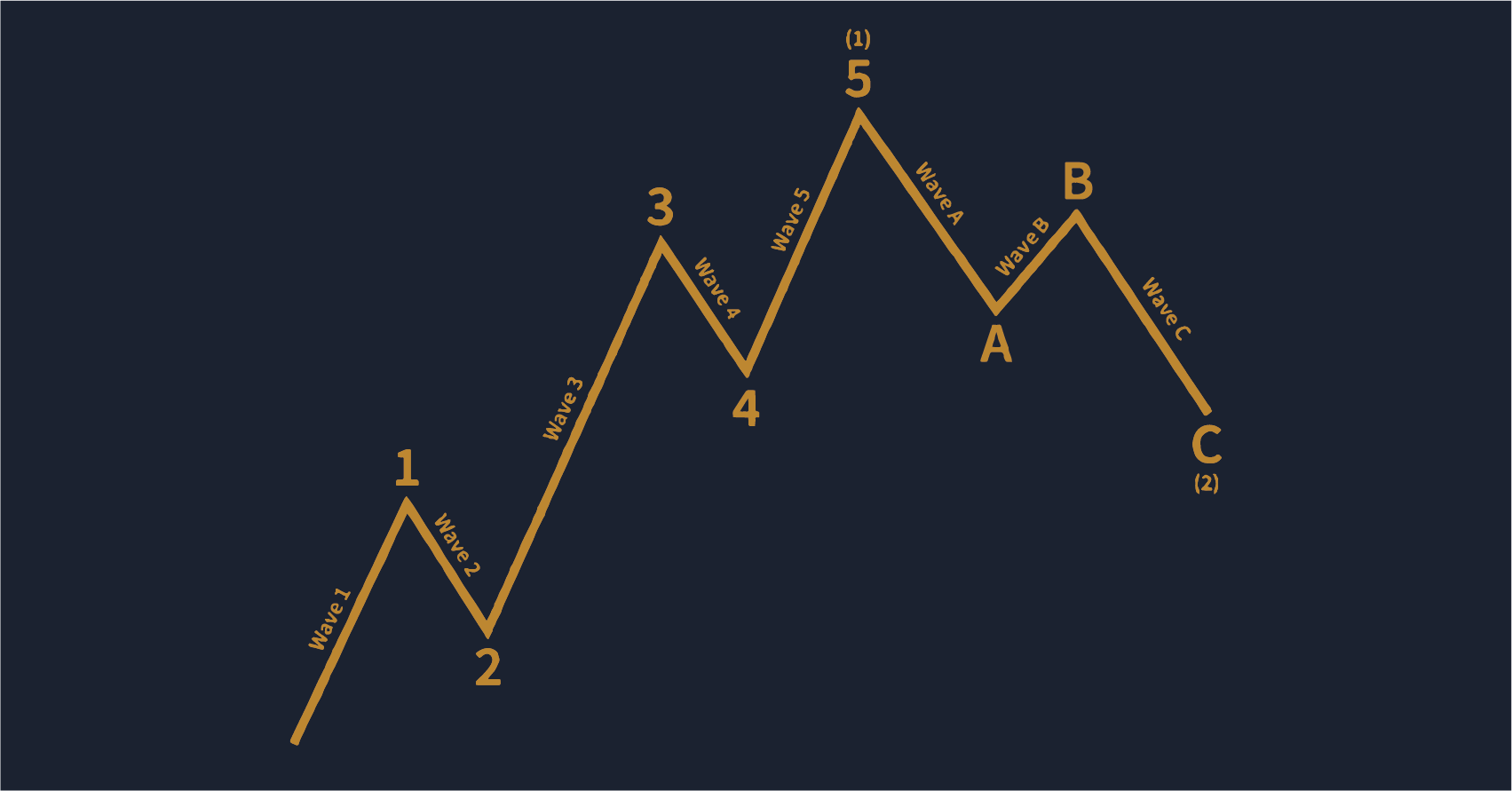

Trading Plan (Your Strategy)

Having a trading plan is like driving a car with auto-shutdown technology on board. The vehicle stops without driver intervention when a collision is imminent. He takes control and stops before the driver even realizes he needs to stop the car.

This feature will save the driver from an accident that will undoubtedly cause pain and financial loss.

Of course, if you’re a Gunbotter, you already have your vehicle, and it comes equipped to handle risk management in crypto trading efficiently.

Here’s a great guide to risk management in Gunbot

A proper trading plan covers three things: entry rules, exit rules, and money management.

There must be proven entry and exit plans. You must know when to enter and exit a position. There is no point in entering a trade if you do not know the criteria that it must meet to exit.

A crypto trading plan will remove all emotion from your trades and thus make you a much more consistent trader. Also, you must manage risk by adhering to a strict and systematic set of money management rules.

Diversification

Diversification is an essential tool in managing trading risks. Depending on your account size, you need to limit the amount of a position to around 5% of your portfolio. Even if you are eliminated from this position, the loss will be minimal and negligible in your portfolio.

Do not put all your eggs in one basket. Expand your portfolio, categorize each asset by its market cap. For example, Bitcoin is the biggest asset with the larger market cap, followed by Ethereum.

Some mid-cap assets can be Litcoin, Monero, and so on, while Small caps can be Ripple and Stellar, and then we have super shit coins like Doge and his son Shiba.

Don’t get me wrong, as a trader, you should capitalize on any trend regardless of the coin. But, don’t mind me, I’m old school with the mindset that Bitcoin is “the coin” everything else is a shitcoin.

So, the point here is that categorizing your assets allows you to know the amount of risk worth investing in.

In addition, diversification shouldn’t just be about how many crypto assets you have in your portfolio. It should also involve other crypto sectors, like Spots, Futures, and Margins.

And finally, diversify on crypto trading exchanges. Can you see now why a Gunbot Ultimate license is essential?

Spreading your capital on five or more exchanges can help you keep your money safe.

Calculate the size of your trades (Trading Limit)

Many new traders forget the mantra, “Let your profits run and cut your losses.” As the saying goes, if you have a profitable position, it is better to allow this trade to reach its full potential rather than close it at the first sign of a small return.

Gunbot users know the magic word “TrailMe“!

On the other hand, if you have a position moving against you, it is better to act quickly to get out of that position before the loss becomes too large.

One method of sizing trades based on principle is position sizing. The idea behind this is that you establish the number of assets on the risk of the transaction. It risks the same percentage or fraction of account size on each trade.

For example, the 2% rule—you might risk 2% of your account size on each trade. Never chase your loss.

If a trade keeps entering a loss, the chances of turning it right are too small to risk more money on it. Too many losses affect human psychology.

When this happens, the odds of making a profit are just too low to risk more capital in addition to the initial risk.

Use the suitable types of commands.

To trade safely, at a minimum, be sure to familiarize yourself with the following types of commands:

- Market order: This type of order is used to execute a trade at the current market price.

- Stop order: This type of order is used to exit a trade at a specific price. Stop orders are placed below the prices currently available in the market. In a long position, the sell stop-loss order would be lower than the current market price. On the other hand, you would place the buy stop-loss order at a level higher than the current market prices in a short position.

- Limit order: A limit order is used to exit a trade. Limit orders are placed above the current market price. You would place a limited sell order above current market prices to secure profits in a long-open position. If you are looking to profit from a short position, you will place a limited buy order below current market prices.

Gunbot usually uses limited orders on its basic strategies, but the StepGrid/SpotGrid family use market orders.

Top newbie traders mistakes

Crypto trading is fraught with pitfalls, but these are often avoidable mistakes that cost inexperienced traders money. If you don’t make silly mistakes trading, you will increase your chances of success.

Poor Risk Management – This is the most common issue among new traders, the tendency to risk too much money on each trade or don’t exit a losing trade quickly enough.

Experienced traders cut their losses and move on. Never risk more than 2% of your total capital in a single trade as a rule of thumb.

Set an appropriate Trading Limit amount per trade on your Gunbot strategy.

Here are some tips to make sure you use proper risk management in crypto trading.

Overthinking – New traders overthink about where the market will go, which has two drawbacks:

- They don’t trade enough, which reduces their potential to make money.

- When they eventually enter the market, they have put so much thought and effort into their trade that they are so into it and are unwilling to exit such a trade with a nearly instant zero trade or a slight loss.

It’s somewhat embarrassing after thinking a lot and putting so much time into it. Here is where overconfidence steps in. Traders ride on their analysis even if it’s on loss—due to their inability to accept so quickly that they were wrong.

Rather than entering into a trade with the confidence that you are right, you should instead enter each transaction with the assumption that you are wrong with a willingness to react correctly if, indeed, you are wrong.

Lack of a trading plan is a typical problem that we see all the time with our new traders; they can’t seem to stop pulling the trigger and jumping on almost every opportunity. They often enter the market at the wrongest time.

If you do not have a trading plan, you’ll be reacting to the market’s volatility at every slight opportunity. Having a strategy is vital; boredom trading is a sure-fire way to destroy your account.

Lack of discipline – Many beginners tend to start strong and end up losing or, worse yet, imploding and destroying their accounts.

If risk management in crypto trading is the key to the business, then discipline is the key to opening the door. If you can control your emotions and stick to your principles and goals, you have a much better chance of success in long-term trading.

Taking unripe profit – New traders spend a lot of time repeatedly selecting, planning, and executing new positions. Still, they regularly make the mistake of exiting those trades with much less thought. This is unfortunate, as it is the output that will determine whether a transaction was profitable or not.

It is human nature to take profits in a hurry. In contrast, the worry of incurring losses will cause the same trader to leave underperforming positions open, hoping that prices will move in the right direction and reduce losses or even turn them into profitable trades.

Again, take advantage of the “trailing” feature in any Gunbot strategy.

Neglect of stop-loss and take-profit orders – Several new traders make the mistake of not closing underperforming positions fast enough. One tool that makes this less complicated is a stop-loss order.

You can set a Stop Limit on Gunbot if you want to use that approach.

Once you have determined a price level that matches the level of risk you are willing to take on a particular trade, you can automatically place a stop-loss order at that level to close the transaction.

This eliminates the human aspect of the exit, reducing the risk that the emotion of hope will interfere with rational decision-making.

Conclusion

Crypto trading is not a get-rich-quick scheme.

Crypto trading is a game of Risk Management.

Even with so many strategies, indicators, and analytical tools, these strategies are not 100% guaranteed.

Each trading strategy has its pros and cons. It is vital to integrate risk management into your trading, regardless of the type of strategy you’re using.

Understanding and following proper crypto trading risk management steps will help you minimize your losses while earning steady profits.

Strictly following your risk management in crypto trading will help balance your emotion with trading adding and putting the odds in your favor.

To be a successful trader, always stick to your risk management plan and don’t FOMO, and your emotions take over.

Many Gunbot users benefit from these risk management strategies or even use others techniques like DCA in their daily trading.

But what if you don’t have Gunbot yet? Now is time to grab your copy from one of our Official Resellers and get on your road to success.