Version 1: Introduction to a Gunbot Basic Gain Configuration

Version 1: Introduction to a Gunbot Basic Gain Configuration

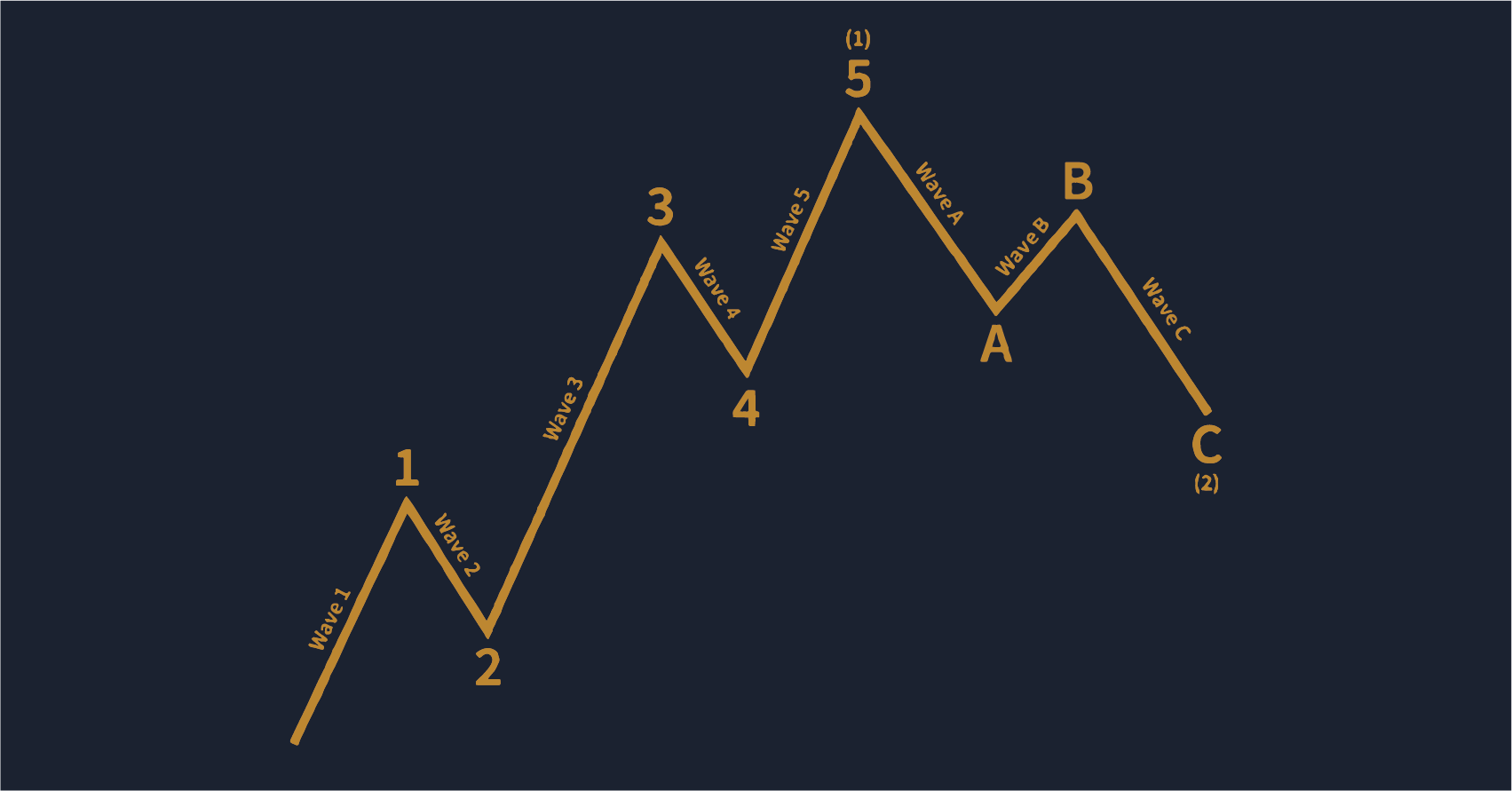

Welcome to the first version! This will be an introduction to the basic setup getting you familiar with the Gain strategy, Trailing, Dollar Cost Averaging, & AutoConfig scripts. The logic behind these settings is an attempt to ride every single wave of the market as it ebbs and flows. It’ll mainly make sub percent trades but will attempt to move with the market as much as possible. This is why it uses trailing instead of a set Gain amount.

Now you might ask, why are you still using Gain over just setting up a TSSL strategy. That’s because I’ve experienced issues over numerous versions when using TSSL then enabling other secondary trailing features. However, this is probably thanks to a lack of understanding conflicting settings and not the program itself. That said, everything works as I expect when I just use Gain as a base then enable additional features on top of it.

A little information about expectations in this version upfront. Testing was done on Coinbase Pro while paying pretty hefty trading fees. (more on this later) Starting with $200 entry purchases and a maximum bag size of $1800 my average trade return is $1.70. Though goes from $0.10 all the way to hero trades of $10+ throughout the day.

It has a pretty extreme range as it’ll always attempt to get in or out of a market as soon as the tides start traveling in the opposite direction. Though thanks to trailing it still benefits from riding large spikes when they occur. How much total return you’ll see per day is heavily dependent on market conditions.

Configuration Settings: (only changed settings listed)

-

- Buy Method: gain

- Buy Level: -10 (discussion below)

- Sell Method: gain

- Gain: 0.25 (discussion below + gdax specific setting)

- Trading Limit: 200 (depends on how much you have to work with)

- Min Volume To Buy: 11 (gdax specific setting)

- Min Volume To Sell: 11 (gdax specific setting)

- Funds Reserve: 1

- Period: 1

- Medium EMA: 60 (almost doesn’t matter anymore)

- Fast EMA: 30 (almost doesn’t matter anymore)

- Double Up Enabled: on

- DU Cap: 0.2

- DU Cap Count: 12 (depends on how much you have to work with)

- DU Method: 0.5 (will change with autoconfig)

- DU Buydown: 0.5 (will change with autoconfig)

- TrailMe Buy: on

- TrailMe Buy Range: 0.05 (will change with autoconfig)

- TrailMe Sell: on

- TrailMe Sell Range: 0.05 (discussion below)

- TrailMe DU: on

- Market Buy: on

- Market Sell: on

- Market DU: on

- Delay: 0 (in your exchange settings)

Settings Discussion:

So, let’s start out by talking about a couple settings in particular. Buy Level, this is set at -10 so that it basically disables EMA protection. A couple of versions back, you see to set this at 0 to disable it, as still noted in the Gunbot Wiki TSSL example description of a “pure tssl”. Though somewhere down the line this changed and a setting of 0 just became zero percent below EMA instead of turning it off.

This caused me a lot of trouble for a while but when looking into Grid I noticed Pim (@boekenbox) was able to use -10 to effectively do the same thing as disabling it. Now for people wondering why this is important. This allows for you to profit on the way up instead of waiting for the markets to cross back down below your EMA. This makes a HUGE DIFFERENCE to your earnings. Normally you’d be sitting through bull runs as there just wasn’t a good deal to be had as the price will always be above your EMA lines.

Changing this allows you to keep purchasing and profiting no matter what the market is doing. I mean there’s only two options right? It’s either going to continue going up after a purchase which means you’re going to make money or it’s going to go down which will allow you to buy more coins at a lower price. Why would you want to stop making money on the way up? You wouldn’t and understanding this is half the key to success.

This is why next to the EMA settings above I wrote “almost doesn’t matter anymore” as we’re effectively disabling it. Though I still like the settings as they chart properly, and I can watch the graphs live in the client. Now let’s talk about the Gain setting. This is set to 0.25 though in the past I’ve often ran it at 0.1. Let’s discuss why we’ve increased it. The trailing on sells setting of 0.05 will run downwards past your sell at line as long as it doesn’t also cross your breakeven line.

This means in actuality at worse you’re going to sell for 0.2 percent profit. If you’re wondering why you’d want to do this it’s because dumping your heavy bags and resetting your position at a small profit is often better than watching the markets tumble into the darkness while you’re still holding. If you empty, your funds are free & the next dip is nothing but a great opportunity to start the buy cycle again.

The problem with doing Market Orders on Coinbase Pro (outside of the expensive trade fees) is their price guarantee is +/- 10%! Which when put into practice means while running at a really lean setting of say 0.1, it’ll occasionally spit out trades that we lose money on. They’ll show up anywhere from -$0.005 to like -$0.25. @_@ As you can imagine, we’re not here to lose money we only want to make it.

By upping it just a bit to 0.25 it accounts for this slippage and I’ll generally never see a negative trade. I might only make a couple cents sometimes, but it’s at least always profitable while remaining extremely agile. You’re rarely ever going to be trading off at this small of a profit it’s just important to preserve as much ability as you can for getting in and out of markets.

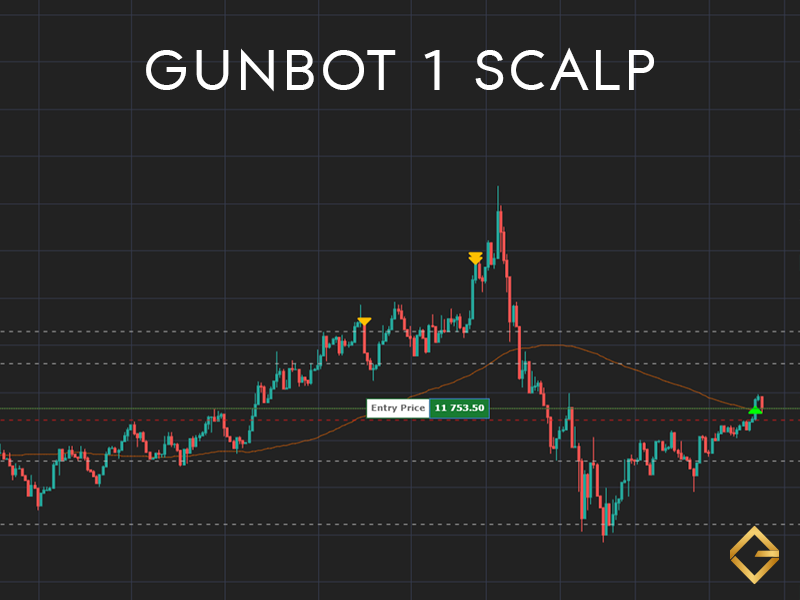

Now let’s talk about those tight buying and selling trailing percentages. I’ve done a lot of testing and find the bots default 0.5% to be way-to-loose for this application. I’ve even spent a lot of time trying 0.25 & 0.1. The objective of having a flowing sub percent machine gun trader is hitting each up and down as soon as the market even looks the opposite direction.

Having settings of 0.05 will trigger on the same exact market moves as 0.1, you’re just getting more profit as you bought & sold earlier in the direction change. Remember we’re trying to fire off hundreds of trades a day so the difference between buying/selling at a trailing of 0.1 vs 0.05 is huge. This is really all about min-maxing to the best of the bot’s ability.

This also helps with your reentry into a market after selling off. Ideally it would go down so you can say you’ve sold at the peak and are looking for the next dip to buy. Though if it continues to go up, you’re going to have to purchase again and buying as close as to where you last sold off is the best option. The gap between your exit and entry points on the charts is just lost profits in this case.

These settings will dump your heavy bags at profit then reset your position almost instantly if that were to happen. Yes, sometimes you sold out just to see it buy again as the markets continue to fly upwards. You didn’t know if the market was going to go further up or down. It made an emotionless decision to make you money while there was money on the table and that’s why you bought this program.

Another beneficial side effect of having the bot setup this sharply is it’s a dip hunter. Anytime you see swings in the market where there is a high level of volatility it’ll grab at the very bottom of dips even if they only existed for a mere second of opportunity. I’ve got a whole collection of screenshots in a folder called “epic dips” just because they make me smile and serve as a reminder that I’m on the right track with setting up the bot. Now let’s talk about Trading Limit, DU Cap, & DU Cap Count. This is modeled after Gunthar’s post from way back in version 11 called “The Way I Run It“ in which he shows how buying smaller amounts on the way down works better than direct 1:1 double-ups.

Yes, 1:1 will average the distance between your last and new purchases exactly halfway between the two,o but it gets to be insanely expensive quickly. I don’t have unlimited funds so when the markets keep dropping, I need a way of slowly lowering the bar for reentry. 20% buys don’t spend a lot of money at first. The first few rounds are basically there to increase your bag size while the market quickly decides which direction it’s going again. If it shoots back up then great you made a little bit more than you would’ve as you cheaply picked up additional coins while the opportunity was there.

If it starts going down then not to worry you didn’t spend too much yet. Though as the market continues to drop over an extended period of time you keep buying with increasingly bigger orders to where you’re slowly overriding your initial purchases. I generally shoot for a DU Cap Count of 12 and that’s just a sweet spot I’ve personally identified with my own level of investment.

I start with $200 buys so that while playing the sub percent market I can at least make a dollar of profit with the middle ground of 0.5% gain. This means if I don’t do any DU purchases there’s still enough in hand to make a little bit of profit. $100 buys were too little, $300 buys became too big too quickly through the DU process. Not to mention that on the lower end, with some coins like BTC, I couldn’t submit a DCA order of 20% as the amount was smaller than my exchange would let me trade, resulting in an order error. (thanks to my reseller @Leeview for catching that)

The other big factor in picking these numbers is I need to run a handful of markets so that when some of them are having a slow or painful day the others can remain fruitful. In actuality, if I’m running even just a couple of markets, I cannot afford to pay for all of them if 12 rounds of DCA orders are placed. I’m being greedy and utilizing the idea that generally only one or two is having a really bad day so I can use funds from the other pairs that aren’t hurting to better secure their positions for reentry.

This is one of the downfalls of my particular financial situation as I’m dancing the line here. If we go through a crash with all markets down eventually some of them will get caught up not being able to complete their dollar-cost averaging rounds. As some markets come back, these other troubled markets will start finishing their DCA rounds which will immediately burden your newly freed bags. Given this rarely happens, I make more doing this dance than not but it’s far from ideal.

I further manipulate the situation with an AutoConfig file that is as simple as one could write a script. It’s not advanced wizardry like you see from other packages on the marketplace. This leads us into our next section.

The AutoConfig File:

{

"DURange-Fast": {

"pairs": {

"exclude": "",

"include": "-",

"exchange": "gdax"

},

"filters": {

"ducount1": {

"type": "smallerThan",

"ducount": 3

}

},

"overrides": {

"TRAIL_ME_BUY_RANGE": 0.05,

"DU_METHOD": 0.25,

"DU_BUYDOWN": 0.25

},

"clearOverrides": false,

"schedule": "*/10 * * * * *",

"type": "manageOverrides",

"debug": false,

"enabled": true

},

"DURange-Normal": {

"pairs": {

"exclude": "",

"include": "-",

"exchange": "gdax"

},

"filters": {

"ducount2": {

"type": "biggerThan",

"ducount": 2

},

"ducount3": {

"type": "smallerThan",

"ducount": 6

}

},

"overrides": {

"TRAIL_ME_BUY_RANGE": 0.05,

"DU_METHOD": 0.5,

"DU_BUYDOWN": 0.5

},

"clearOverrides": false,

"schedule": "*/10 * * * * *",

"type": "manageOverrides",

"debug": false,

"enabled": true

},

"DURange-Slow": {

"pairs": {

"exclude": "",

"include": "-",

"exchange": "gdax"

},

"filters": {

"ducount4": {

"type": "biggerThan",

"ducount": 5

},

"ducount5": {

"type": "smallerThan",

"ducount": 9

}

},

"overrides": {

"TRAIL_ME_BUY_RANGE": 0.1,

"DU_METHOD": 1,

"DU_BUYDOWN": 1

},

"clearOverrides": false,

"schedule": "*/10 * * * * *",

"type": "manageOverrides",

"debug": false,

"enabled": true

},

"DURange-LostInSpace": {

"pairs": {

"exclude": "",

"include": "-",

"exchange": "gdax"

},

"filters": {

"ducount6": {

"type": "biggerThan",

"ducount": 8

}

},

"overrides": {

"TRAIL_ME_BUY_RANGE": 0.25,

"DU_METHOD": 2.5,

"DU_BUYDOWN": 2.5

},

"clearOverrides": false,

"schedule": "*/10 * * * * *",

"type": "manageOverrides",

"debug": false,

"enabled": true

}

}AutoConfig Discussion:

What this file does is simply check your market’s DU Cap Count every ten seconds. It then changes the Trail Me Buy Range, DU Method, and DU Buydown depending on what range out of four it falls into. The first is Fast, this says you just exited a market and are looking to get back in. Ready to snap some coin up and get rid of it like a machine gun. It contains three rounds of dollar-cost averaging at very sharp purchase levels. This is great when markets aren’t fluctuating a great deal as it lets you buy the tiny dips then get rid of them at profit over and over.

The next range is called Normal, it keeps the same Trail Me Buy Range but extends the Method and Buydown by double. This stops the bot from rocketing through your DCA rounds when things are just starting to go downhill. By doubling the distance you’re saving yourself twice the buy-ins. This occurs for another three rounds.

After that, if things continue to go down, we’re now in the Slow range. This really reduces how often you’re purchasing by upping the Trail Me Buy Range to double what it was before, now at 0.1. It also doubles the Method and Buydown again to 1.0. It’s important to notice how we’ve dulled the edge a bit so the market has to start coming back more before it’ll trigger. It also has to travel at least a full percent (twice the distance again) before it can happen. This also occurs for another three rounds of dollar-cost averaging.

Then finish it up; if all hope is lost on the market, those coins will be put in the Lost In Space range. This is for the last possible rounds of dollar-cost averaging I can afford, the real big purchases. I want the largest range of possible distance down before making these buys to help lower my reentry point. Therefore the Trail Me Buy Range is changed to a huge 0.25 while the Method and Buydowns are increased to over double at 2.5.

Normally I see considerably more travel down than 2.5% as the 0.25% trail range doesn’t accidentally trigger until the markets are actually coming back. It’s a very dull setting and wouldn’t work for the normal sub percent trades I’m trying to make all day. Though once you’re this far out from profitability and down deep into the DCA dungeon you’re playing a very different position.

It’s not the dynamic DCA script you find on the market place but it remains dynamic using the built-in trailing system from the bot. We’re basically just changing the behavior of how we want that trailing to work into four different categories. Like I said before, it’s drop-dead simple. It works well, though I’m sure this is one of the areas more experienced traders/scripters could increase profitability. (as you’ll see in the future versions)

Entrance & Dollar Cost Average Excel Calculator:

I created a very simple excel file to help me determine what the proper levels for initial purchases & dollar-cost averages should be. You can simply enter your initial buy-in, how much you want to double-up per round, & how much your trade fees are then it’ll do the rest.

It’ll conveniently plot out twenty rounds for you to look at. It has three separate calculators on the same page so you can easily play with the settings and compare them without having to take screenshots or write the results down. This is also handy for when you’re changing the amount of your double-ups via an AutoConfig script. Simply use one calculator to see the initial rounds, then take the number from your last round before changing it and place it as the starting point in the next calculator.

Looking to trade with larger or smaller amounts than the example here in the post? How much you can start out with and still get to round 12 of dollar-cost averaging while maintaining the total amount of pairs you wish to run is the correct number. A different way of looking at it would be, total funds divided by pairs. This would give you the maximum size bag you could afford per pair you’re running.

Use the calculator to find what entry price you can afford and you’re off to the markets. Example as per this post: $200 buy-ins @ 20% DCAs means by round 12 I’m holding an $1800 bag. This would be if it bought the perfect amount each time which rarely happens, most of the time it’s slightly less but plan ahead.

I’ve uploaded a copy of this simple excel calculator to google for you to download: here

Simple Things to Earn More Money:

If you’re planning on going down the route I have here and running a sub percent machine gun then it’s all about paying as little in transaction fees as possible. This not only allows you to take home more money but it allows your bot to get in and out of markets faster, making it more agile. You want the lowest possible bar to reentry and Coinbase, even their Pro side, isn’t the place for this.

I’ve done just shy of a million in volume this last cycle already. They change your trading fees based on how much volume you’re pushing. This means I’ve gone all the way from 0.5% fees to where I’m currently at which is 0.1% maker fees and 0.2% taker fees. This version of the bot is configured to always make Market Orders so it’s paying 0.2% each time. This is too high and costing me an arm and leg. I’ve paid over TWO GRAND in fees so far this cycle alone.

A quick look around an exchange listing shows Binance offering an entry-level 0.1% fee for both making and taking. No additional volume required and that would cut my fees by HALF. I’d have made over $1000 more by just taking my business over there which is nothing to scoff at.

It goes to show that where you do business is just as important as how you’ve setup the bot. Find a quality exchange that is going to appreciate your Gunbot. Don’t forget to lockdown your account access, setup 2FA, and whitelist your bot’s IP. Do every additional security enhancement possible. We live in a time where Gunbot accounts are generally a good target so make sure to protect yours.

Volume Update: (million+ coinbase pro still too expensive!!)

Conclusion:

End of the day this configuration is drop-dead simple and provided pretty good returns. Utilizing $5K in funds I’ve been seeing $25 on terrible days, averaging $100 plus on normal days, and I’ve seen as high as $200 on monster days. Though in all honesty, I could’ve just been getting extremely lucky as the markets have been very kind lately. It’s not hard to make money when everything is bull popping off booming and zooming.

It’s also important to know your weaknesses. These settings DO NOT handle massive market drops well. The only thing you can do about this is set a stop loss to get your bot back on track once you’ve maxed out your funds via dollar cost averaging or… sit around and wait for them to come back someday. Holding.

If you’ve got more resources you could always expand the rounds at which you can run DCA purchases. There’s probably a range deep into your pockets that you’d never really lose sight of the markets and stay trading all the time. I’m not able to test that and as discussed have decided playing more markets is the solution to sustained profits.

Overall, the real test of a bot configuration is how it handles bad days, back-to-back bad days, into bad weeks. How much you profit over a month, a quarter, into a year. I don’t have that data for you as I’ve been working on improving the configuration instead of running long-duration trials.

I’ve been using Gunbot for years while trying to develop the perfect settings to play every possible hand throughout the day. I want it to be superhuman and often challenge it by sitting for twelve hours with the markets open doing it by hand. It can beat me most the time, I think and process situations differently than it does.

My human brain goes for larger more profitable trades while it’s over there consistently winning all day at the tight game. It’s emotionless and that’s the beauty. It works while you sleep, while you’re out with your kids or on a date, it’s making you money while you’re not thinking about markets. That’s well worth the cost of the license.

Hopefully, this post has given you an introductory lesson in understanding the bot and succeeding in spot trading. This is worth your time, do not give up if you’ve been having trouble finding the profits. You’re always welcome to come to talk to us in the official Telegram groups and of course encouraged to continue with my additional posts in this blog.

Cheers, everybody, thanks for reading!

Next Up: Version II – The Cautious Community Machine Gun

Previous: Introduction to Gunbot, A New User Experience Blog & Guide

Disclaimer:

This series is not financial nor investment advice. These are ideas and opinions for information purposes only. Seek a certified financial professional for investment advice. If you’re going to get into this for a career or even as a major part of your financial capabilities then take caution, do not play with more than you can risk. Market’s crash, the losses always come faster than the gains, a dollar earned will be a hard, painful journey, but a fortune lost will come in the blink of an eye. If you want to keep waking up comfortably in your be, never play with your rent/mortgage /survival money.