Gunbot Strategy Overview Pullback for Futures Markets

Gunbot Strategy Overview Pullback

It’s been a long time since I published an Overview for our professional Market Maker bot, and my main goal is to have all overview Market Maker strategy variants in viraltrading.org so people don´t feel lost in the dark when trading futures with a Market_Maker bot.

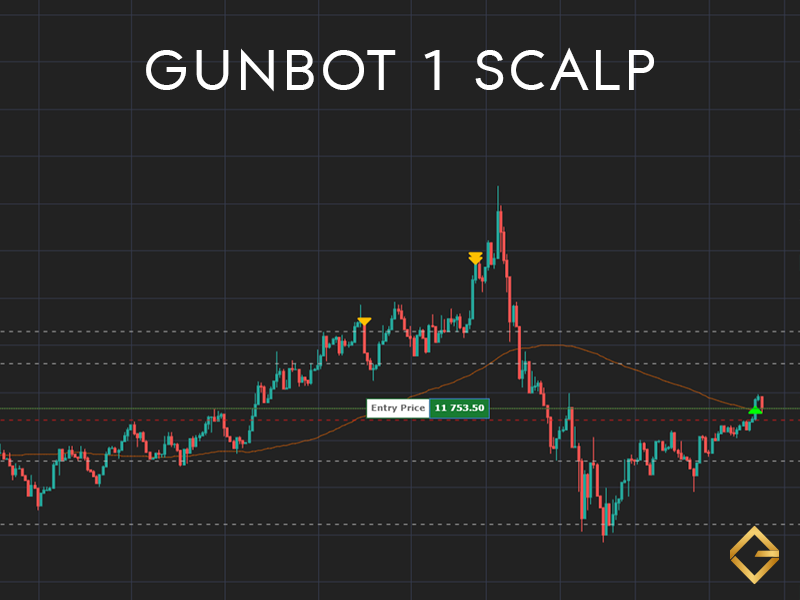

The Gunbot pullback strategy is one of those under-valuated market maker strategies or at least not so used as others like Grid, MOTION OF THE OCEAN, or 1 Scalp.

Without further ado let’s analyze how it works the Pullback strategy.

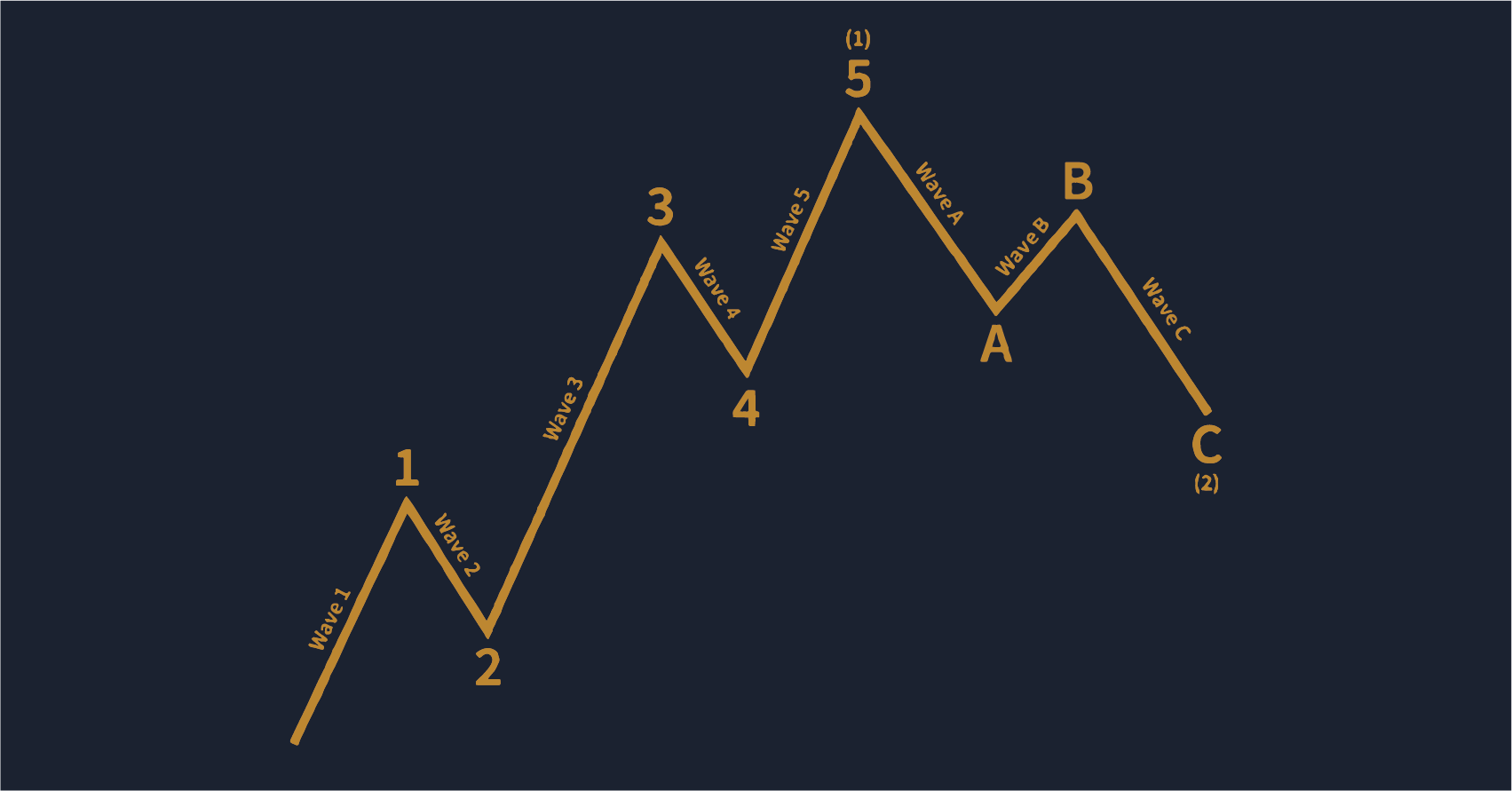

The pullback strategy is based on emas and focuses on finding good entry points on pumps and dumps.

What is the Pullback Strategy?

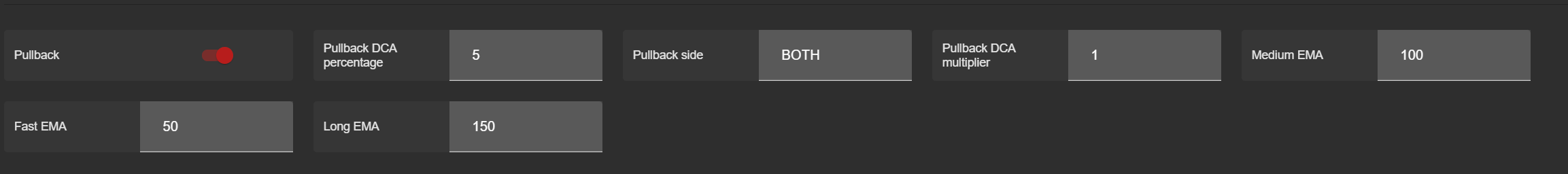

This strategy uses 3 ema:

Default config:

- – ema1 short period 50.

- – ema2 medium period 100.

- – ema3 long period 150.

An example of pullback is when the price goes below ema1 and ema2 during a pump and then bounces above ema1 again we will open a long position.

Below is an example of possible entry targets for the Pullback strategy.

How to configure in Gunbot Market Maker Pullback Strategy for trading with Futures.

- – Create a default legacy MM strategy, configure the way you like your ROE, and configure your risk level.

- – Go to Strategy variants and configure like the image below.

- – Set DCA method either to Native or Tenkan DCA, that´s personal preference,

You can see in the table below the list of parameters used in the Pullback strategy.

[wptb id="4222" not found ]That’s all folks, see you next time, and happy gunbottin’.