New Gunbot Stable v26 Released

New Gunbot Stable v26 Released

Hi all folks,

Welcome back to another exciting Gunbot Stable release! We want to express our heartfelt gratitude to our incredible community. Your unwavering dedication and passion have been instrumental in shaping Gunbot into the finest crypto trading bot in the market. Now, without any delay, let’s dive into a recap of the remarkable enhancements and features, some of which you may have already had the chance to explore in our beta builds.

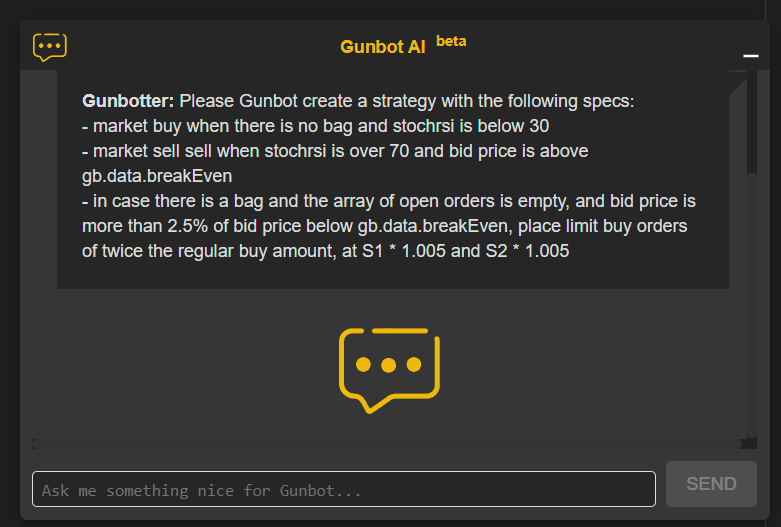

ChatGPT added to Gunbot in custom Strategies

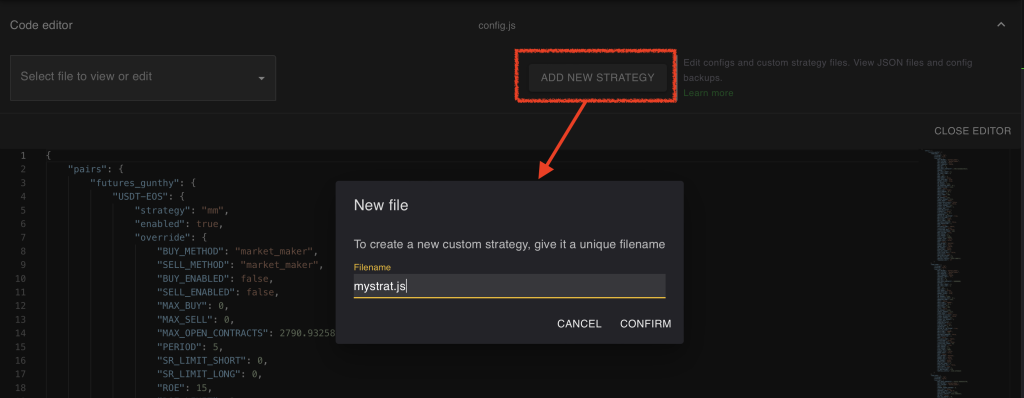

Our custom strategies have elevated the thrill of trading by allowing users to create their own trading strategies, such as the quantaG strategy in Gunbot. With ChatGPT integration into Gunbot, even those without coding experience can effortlessly create their own custom strategies. Simply describe your desired outcome to ChatGPT prompt in the code editor in our GUI and watch it come to life with ease.

How to create your own customStrategy using ChatGPT directly from the Gunbot GUI

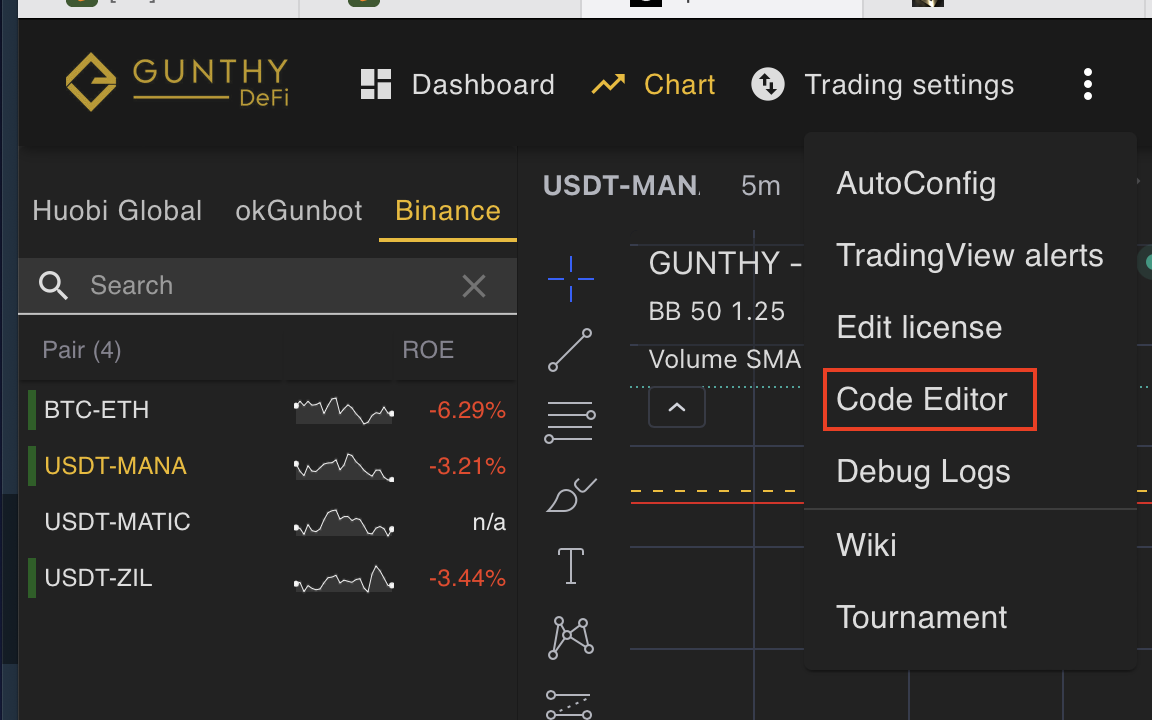

Open Gunbot GUI in the browser.

Click in the top menu – Open Code Editor.

- Select Create New Strategy.

- Set a name and click maximize in the Gunbot AI Prompt.

- Then just type your request. please clearly state what you would like to accomplish with the strategy, using plain English or your own language. The more accurate your request, the better the resulting code will be.

- After a few seconds the code it’s generated, review the code, and you can give more instructions to refine it if you need.

- At the end just click SAVE in the bottom of the Gunbot AI form or Copy in case you want to paste in the code editor or directly save in a document.

Congratulations! You have successfully created a custom strategy using purely driven artificial intelligence, isn´t that incredible?

Some things to take into consideration when using Custom Strategies created by AI.

Initially, load the strategy and examine the code. There may be some small errors or inaccuracies in the math. However, OpenAI claims to have improved its mathematical calculations in its latest build. It would also be useful to gain a basic understanding of the JavaScript code for practical use in a production environment.

Before using it on a production server, test your new AI strategy in the Gunbot simulator.

Metamask integration in Gunbot

Gunbot now integrates directly with Metamask, eliminating the need to re-confirm your license with the backend system. Your license information is stored on the Ethereum blockchain and tied to your Metamask wallet. To use Gunbot, simply enable it with an internet connection and your Gunthy license information will be automatically retrieved from the Ethereum blockchain.

“Your Gunbot no longer will need to call home”.

With safety in mind, be sure to take the necessary precautions to secure your Metamask wallet before integrating it with Gunbot.

Caution: Due to the needed security, it will not work any longer from mobile application to login to your Gunbot GUI as there’s no option to validate through your mobile browser in metamask.

New Stepgrid Scalp Futures Strategy

A futures strategy similar to the spot stepgridscalp strategy, except that it does not partially close trades with prices below the average entry price (excluding small stop losses). The default settings in this strategy differ from the spot and result in a higher trading frequency.

This strategy currently operates in long-only mode, with short mode to be added in a future release.

Key Features:

- Multi-timeframe monitoring: User-configurable low, medium, and high timeframes for monitoring trend changes, momentum strength, and more. For example, trade on 5-minute charts while monitoring 15-minute and 4-hour charts.

- Dynamic Trading Styles: Automatically switches between normal grid trading, cautious scalping in upper ranges, trading supports, and different sell trailing styles based on market conditions.

- Trade Supports: Switches to a mode where it trades higher timeframe supports with limit orders when the market looks unfavorable.

- Sell Trailing Styles: Includes regular trailing with dynamic trailing ranges, candle low trailing, and micro stop loss style.

- Quick Trend Detection: Detects trend direction changes quickly.

You can read all documentation and parameters explanations in our Wiki.

New Feature in stepGrid Scalp and stepGrid Futures called BTFD

We are delighted to introduce an exhilarating innovation for you.

Presenting the groundbreaking “B.T.F.D” algorithm, now available in the SGS strategy for SPOT and Futures markets.

What does the acronym B.T.F.D stand for?

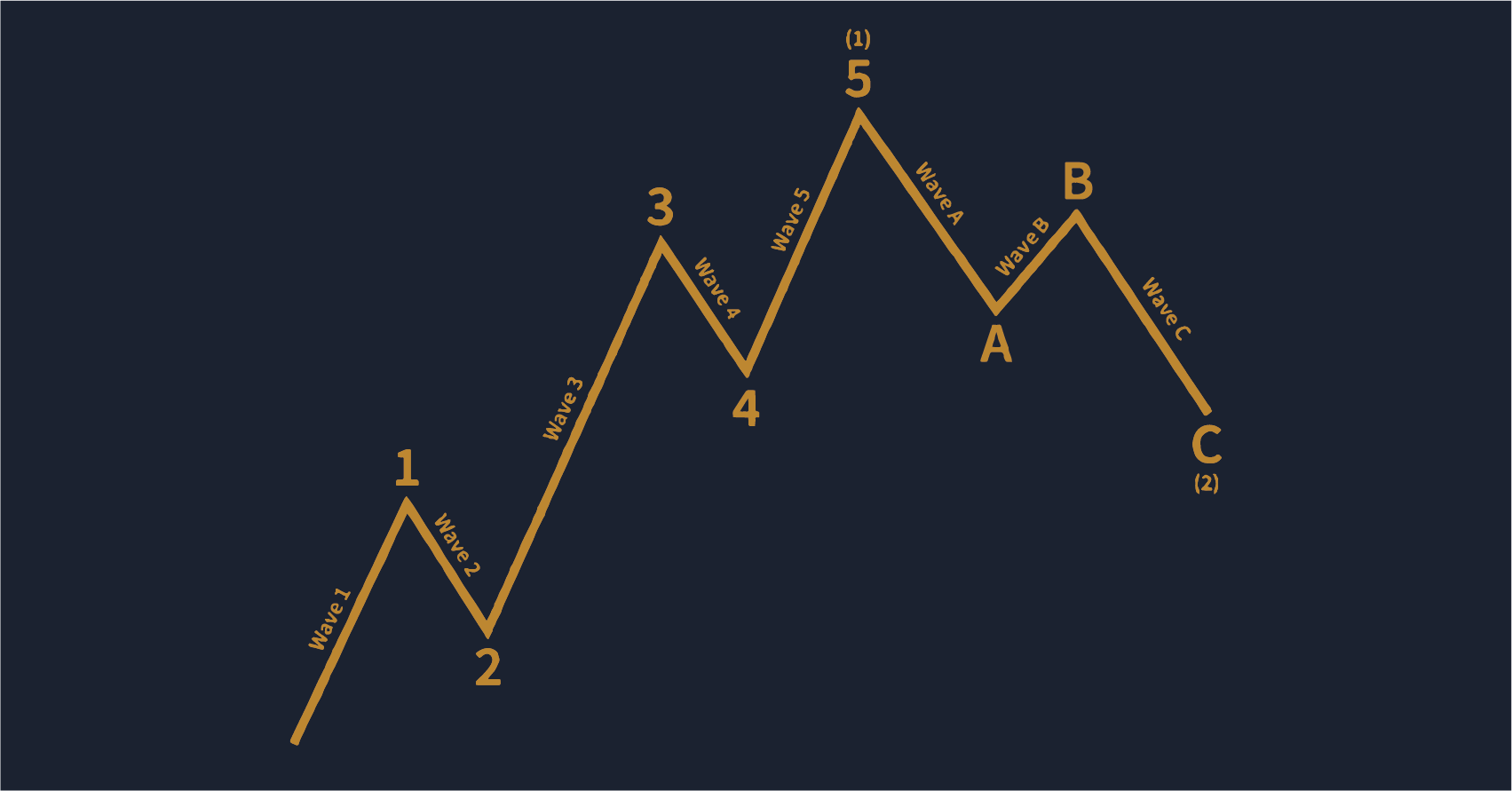

It translates to “Buy The F***ing Dip” in trading parlance. This expression is employed when traders observe a decline in the price of a volatile asset and regard it as an excellent opportunity to acquire it before the value resumes its ascent. Such an expression reflects a short-term investment approach based on buying during dips. It primarily applies in bullish markets, where the overall trend is positive and investors anticipate the price will continue to rise following a brief correction.

Thus, our innovative “IRIS-Trend | BTFD mode” algorithm does precisely this: it relies on other algorithms within the family (IRIS-Trend) to monitor the trend and price behavior dynamically until rapid corrections exceeding the thresholds of pivot points S1 or S2 occur within a general long-term bullish trend. This enables you to purchase during dips intelligently and sell at a profit.

What makes IRIS-Trend BTFD exceptional and distinct from other algorithms?

Here are some notable features:

Dynamic price action tracking: securely purchase dips through the automatic creation of an advanced GRID with a high likelihood of absorbing the negative deviation caused by price corrections, fundamentals, or manipulation, subsequently selling at a profit. Manual configuration of these values is also possible.

Adaptability and diversity: Offers the ability to operate seamlessly in conjunction with other IRIS-TREND algorithms, thereby providing an efficient option for capital management, monitoring, and intelligently trading demand zones while other algorithms handle management in supply zones.

Robust capital protection: Through a solid DCA strategy, multipliers, and the automatic or manual adjustment of GRID size, conservative trading in intraday periods exceeding one day is possible.

Granular flexibility: Allows traders to operate exclusively using a THROWBACK approach (buying only retracements) or combine with other “IRIS-Trend” algorithms to create a broader trading strategy.

And this is just the beginning: thanks to our dedicated community of beta-testers, you will soon see further enhancements and innovations in this algorithm. Don’t miss the opportunity to delve into the thrilling world of “IRIS-Trend | BTFD mode” and capitalize on cryptocurrencies even in the most tumultuous markets.

Dare to explore our algorithm and embark on your adventure toward more intelligent and profitable trading.

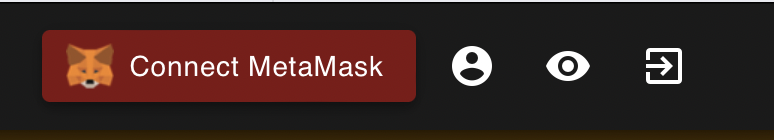

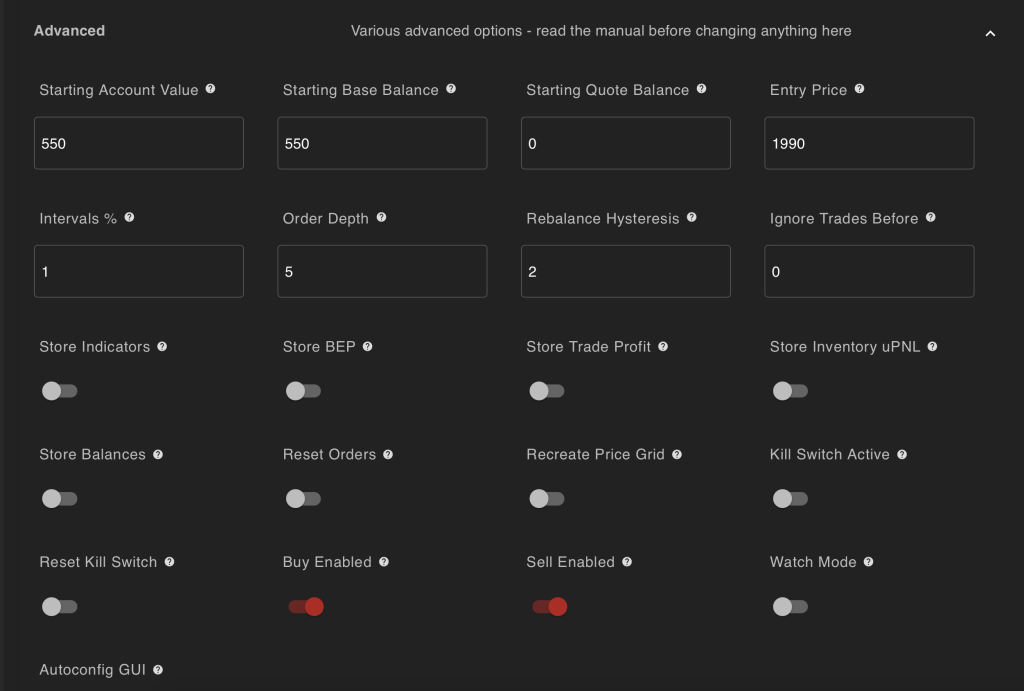

New Features in Custom Strategy QuantaG

- New Market Maker mode – high frequency trading on a 24hr support/resist window.

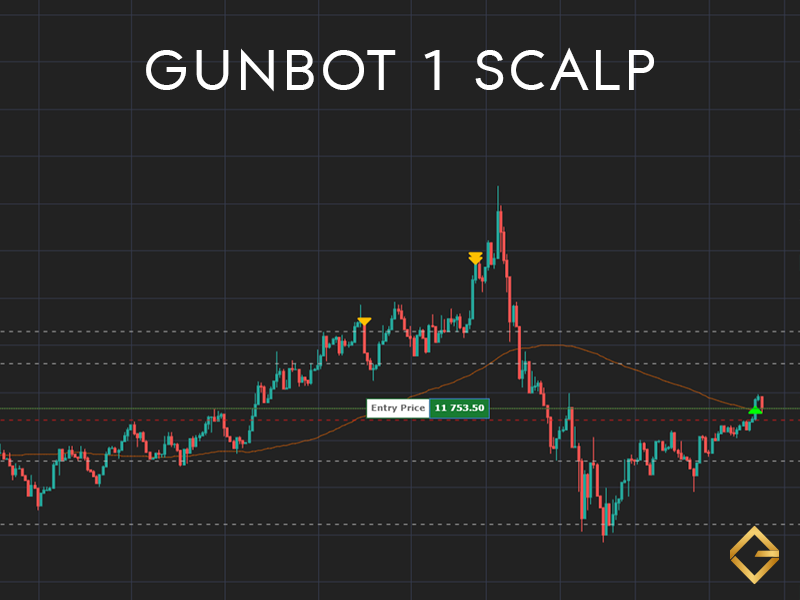

you can see below some screens from latest Quanta G chart

- Added optional volatility controllers using either Parkinson, Garman-Klass or Yang & Zhang volatility measures.

- Added gui-based strategy setup which simplifies setup and management.

- Added kill switch where trading is stopped until manual reset.

- Added Sortino Ratio financial indicator.

- Implemented BEP based on actual algorithmic performance (removes issues with FIFO or LIFO profit methods).

- Added default to post-only orders with logic to fall back to limits or replace post-only if price action is highly volatile.

- Key stats can be made available in state file for exploitation with AC

- Added ability to export balances to json on each cycle for external analysis

Significant code refactor and optimization.

New Features in Tradingview Webhooks

First of all, it’s important to know due to the technicalities of trading Futures it’s mandatory to have the pair you want to trade from tradingview.com enabled and spinning in Gunbot.

- A new command has been added – fliplong and flipshort – allowing you to flip your positions directly from tradingview.com. The fliplong command will first close your current position and then flip the side to long, while the flipshort command will close your current position and flip the side to short, depending on your initial position.

Added Bitget futures swap contracts

Under the latest stable version, you can start trading Bitget swap contracts. You can use your own custom strategy or our fabulous stepgrid hedge strategy

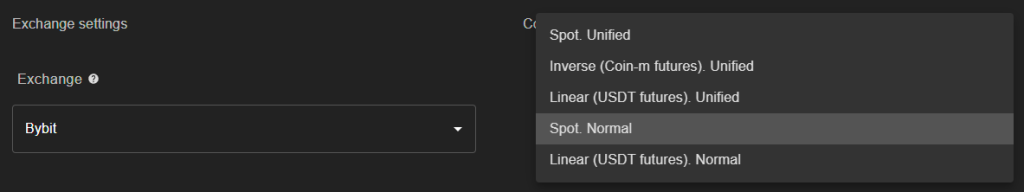

Revamped Bybit spot & futures trading Experience

In light of significant developments at Bybit concerning the transition from UMA to UTA account types, Bybit has revamped its API integration. As a result, a comprehensive overhaul of the Bybit integration was necessary.

You will need to change the bybit market type here’s how.

How to Edit Your Market Type

To adjust your market type, follow these straightforward steps from our GUI:

1. Access Your Profile: Start by clicking on your profile icon.

2. Choose Exchange tab: select the Bybit Exchange.

3. Navigate to Market Settings: Locate the “Market type” section within the dropdown menu.

4. **Select Your Market Type**: In the market settings, choose the appropriate market type depending in your type of account.

- **UMA**: Universal Master Account – Select Spot. Normal or Linear Normal for Futures trading.

- **UTA**: Universal Trading Account – Spot. Unified, Linear Unified (Futures) or Inverse Coin-M (futures) Unified.

By following these steps, you can easily modify your market type to suit your trading needs.

If you haven’t yet acquired Gunbot, take the initiative and obtain a license from any of our authorized resellers to purchase your new license. Payment options include Bitcoin, over 300 other cryptocurrencies, and PayPal.

That’s all Folks, Enjoy the new Gunbot Stable v26 Released, Happy bot trading & c-u soon.